Manage Your Money with Moneyspire – Easy Personal & Business Finance Softwar

Managing finances can often feel like juggling too many moving parts — budgeting, tracking expenses, paying bills, invoicing clients, managing accounts, and planning for the future. Whether you’re a busy individual trying to stay on top of your household budget or a small business owner looking to streamline your accounting, the challenge is the same: you need a solution that’s powerful yet simple to use.

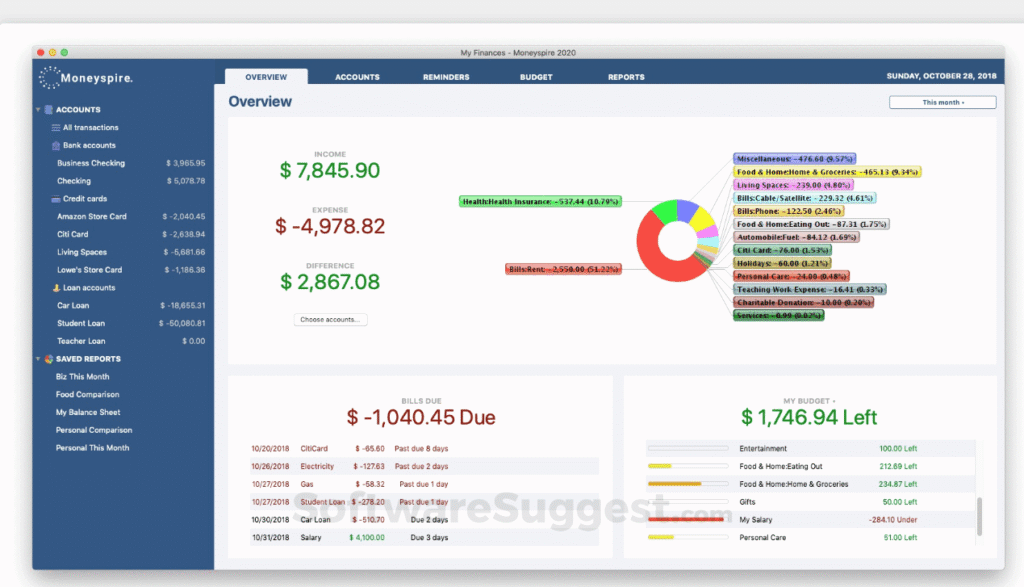

Moneyspire offers just that — an all-in-one personal finance and small business accounting tool designed to bring your entire financial life together in one place. In this article, we’ll dive into how Moneyspire can help you save time, reduce stress, and make smarter financial decisions.

Why Moneyspire Stands Out

Unlike some bloated and overly complex financial software on the market, Moneyspire is designed with clarity and ease of use in mind. Yet it doesn’t skimp on features. It offers robust tools for both personal and small business financial management, making it a rare dual-purpose solution.

1. Unified Platform for Personal and Business Use

One of the biggest advantages of Moneyspire is its ability to handle both personal and business finances in a single platform. Most software solutions target either individuals or businesses — not both. With Moneyspire, you can track your household budget and manage business invoices all from the same dashboard. This means fewer subscriptions, fewer logins, and a clearer overall financial picture.

2. Bank Connectivity and Account Aggregation

Moneyspire connects securely to thousands of banks and financial institutions, allowing you to import and sync transactions automatically. Whether you use multiple checking accounts, credit cards, or investment portfolios, Moneyspire helps consolidate everything into one easy-to-navigate view. You can even manage cash accounts and manually enter transactions for full control.

3. Flexible Budgeting and Expense Tracking

Moneyspire’s budgeting tools are both intuitive and powerful. You can create detailed budgets, set spending limits, and track your progress throughout the month. Unlike rigid budgeting apps, Moneyspire lets you customize categories and subcategories, so your budget aligns with your actual spending habits.

The real-time visualizations and detailed reports make it easier to see where your money is going — and where you can cut back.

4. Bill Reminders and Financial Planning Tools

One of the biggest causes of late payments is simply forgetting. Moneyspire includes built-in bill reminders so you can stay on top of due dates and avoid unnecessary fees. Whether it’s a credit card payment, utility bill, or loan installment, you’ll never miss a payment again.

Moneyspire also offers future forecasting tools that let you project your cash flow weeks or months ahead — ideal for planning large expenses or business investments.

5. Small Business Accounting Features

For entrepreneurs and freelancers, Moneyspire offers a suite of features that simplify day-to-day operations:

- Invoicing: Easily create, send, and track invoices.

- Accounts receivable and payable: Stay on top of what you owe and what you’re owed.

- Customer and vendor tracking: Manage contact details and transaction histories.

- Tax tracking: Categorize expenses and income to simplify tax prep.

This makes it a powerful alternative to more expensive and complex platforms like QuickBooks, especially for smaller operations that don’t need enterprise-level features.

Who Is Moneyspire Best For?

- Individuals and families who want to manage budgets, bills, and bank accounts in one place.

- Freelancers and solopreneurs who need lightweight accounting tools without the hassle of full-scale ERP systems.

- Small business owners looking for an affordable, easy-to-use alternative to traditional accounting software.

- People transitioning from legacy software like Quicken who want a modern, cross-platform solution.

Cross-Platform and Data Portability

Moneyspire is available for both Windows and macOS, with a mobile companion app for iOS and Android. Your data is stored locally or in your own cloud account (Dropbox, iCloud, etc.), giving you complete ownership and control over your financial information — unlike many web-based tools that lock you into their ecosystem.

It also supports QIF, OFX, QFX, and CSV file formats, so importing data from other platforms or banks is straightforward.

Affordable Pricing with No Subscriptions

One of the biggest frustrations with modern financial tools is the subscription model. Moneyspire offers a one-time purchase license — no recurring fees. You pay once and own the software, with the option to upgrade when a new version is released. This pricing model is ideal for people who value long-term control over their finances without being tied to monthly costs.

Final Thoughts

In a market saturated with either overly simple apps or expensive, bloated accounting systems, Moneyspire fills an important niche: powerful, flexible financial management for both individuals and small businesses — all without the steep learning curve.

Whether you’re budgeting for a family vacation, tracking freelance income, or sending invoices to clients, Moneyspire keeps your financial world organized, efficient, and under control.

Try Moneyspire today and take the first step toward smarter financial management.

Visit Our Other Articles: CapCut AI is revolutionizing free video editing in 2025 with intelligent tools designed for faster, smarter content creation.